This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

By Julie Emmrich, WorldGBC Sustainable Finance Lead.

At the end of May 2022, WorldGBC launched an EU Policy Whole Life Carbon Roadmap for the built environment.

In this series of blogs from WorldGBC we are looking at how we developed the Roadmap, our vision for a decarbonised built environment in the EU, and how to get there. We’ll be speaking to some of the people who were involved in the process along the way to get their insights on how this Roadmap can catalyse political action and the steps we can all take to support its implementation.

In this fourth instalment, Julie Emmrich, WorldGBC Sustainable Finance Lead, explores the role of the EU Taxonomy in decarbonising the EU’s built environment.

Why does sustainable finance matter?

Sustainable finance is a powerful tool for improving the standard of Europe’s building stock.

Financial actors’ investment decisions influence the direction of the real economy and could therefore enhance currently insufficient renovation rates of 1%. Investment decisions taken today will have repercussions on the built environment in the years to come, so sustainability must be anchored at the core of these decisions.

Financial markets are increasingly aware of the risks of climate change and directing their investments towards projects and companies that guarantee the achievement of social and environmental development goals in addition to economic profitability. For instance, a group of financial institutions committed to align USD 130 trillion of private capital with the goals of the 2015 Paris Agreement by 2050 through the Glasgow Financial Alliance for Net Zero (GFANZ).

A very significant investment gap remains, and green-washed claims pose a major risk for capital misallocation. The finance sector’s potential to support increased climate action in both debt and equity markets is therefore still under-utilised, and the links between financial activities and their impact on emissions in the real economy remain poorly understood by most stakeholders.

What is the role of the EU Taxonomy in sustainable finance?

The EU Taxonomy of sustainable economic activities is being developed to recognise the financial sector’s important role and the urgent need for investment in more sustainable activities. It classifies economic activities and sectors that make a substantial contribution to climate change mitigation and adaptation, the circular economy, biodiversity, water and pollution.

The legal definition of sustainable economic activities that the EU Taxonomy provides ensures that sustainable finance is indeed ‘sustainable’, and safeguards the path to a decarbonised and resilient built environment by guiding investments.

As a key pillar of the EU Sustainable Finance Strategy, the EU Taxonomy is anchored in key sustainable finance legislations, including the European Green Bond Standard, the Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD). Companies, financial institutions and products on the financial markets with sustainability claims will need to adhere to the EU Taxonomy sustainability criteria.

The taxonomy is intended to be both science-based and dynamic, meaning criteria will be reviewed and updated as needed – following scientific evidence – at least every three years.

What should be the priorities of the EU Taxonomy for the built environment going forward?

The taxonomy’s first years of development and implementation will be key in shaping the criteria and measures with the greatest impact on reducing emissions and restoring ecological systems. These indicators are expected to become embedded gradually in all new projects, with the taxonomy upgraded accordingly.

The Climate Delegated Act comprises the sustainability criteria for climate change mitigation and adaptation, and funds regulated by the SFDR need to report eligibility to the climate criteria. The four other environmental objectives are expected to be passed into law in the next year. From 2024 onwards large companies will also need to report their alignment with the EU Taxonomy.

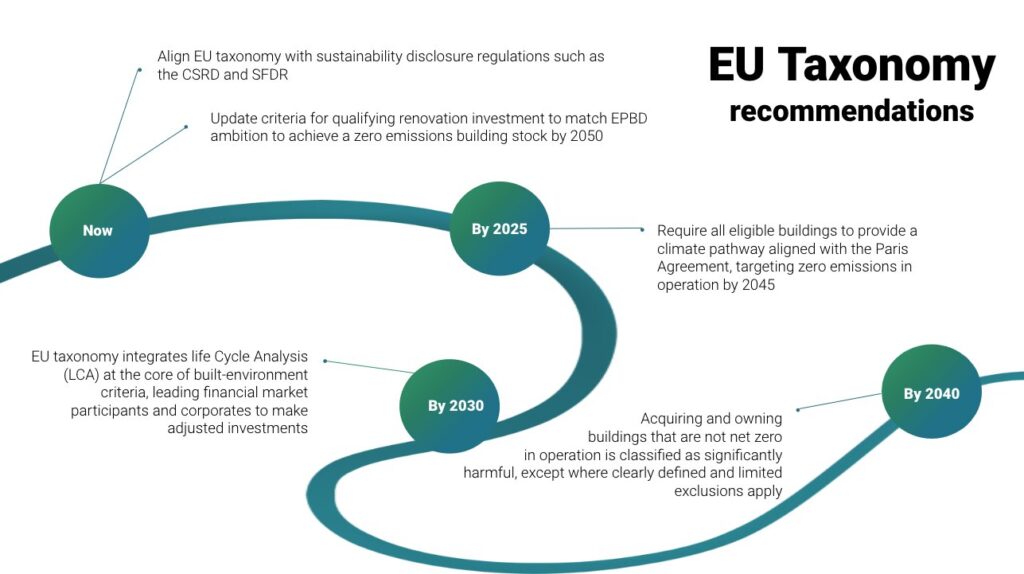

As the EU Sustainable Finance Strategy unfolds in the next few years, the challenges in the implementation of the taxonomy and the updating of taxonomy criteria will evolve. The European Commission will need to develop the EU taxonomy further to safeguard the path to a decarbonised and resilient built environment.

Read more about our recommendations on the EU Taxonomy in WorldGBC’s EU Policy Whole Life Carbon Roadmap for buildings.